GET INSPIRED

GO FURTHER IN LIFE

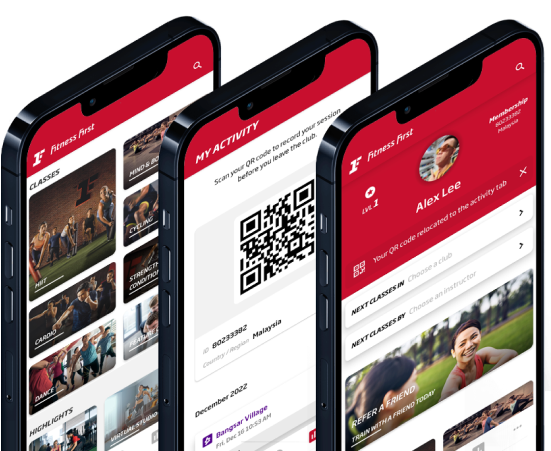

Here's what to expect when you join us now.

OVER 4,000 GROUP FITNESS CLASSES EVERY MONTH

The toughest part is which one to start with

11 Centrally Located Gyms Nationwide

Cutting-edge gym clubs with state-of-the-art fitness equipment, all conveniently located near you.